Build Long-term Wealth

Enjoy higher returns from your investments

Enjoy Peace of Mind

Remain stress-free as you invest

with India's largest Investment Advisor

Achieve your Financial Goals

Watch your investments bloom while

you focus on living the life of choice.

Enjoy higher returns from your investments

Remain stress-free as you invest

with India's largest Investment Advisor

Watch your investments bloom while

you focus on living the life of choice.

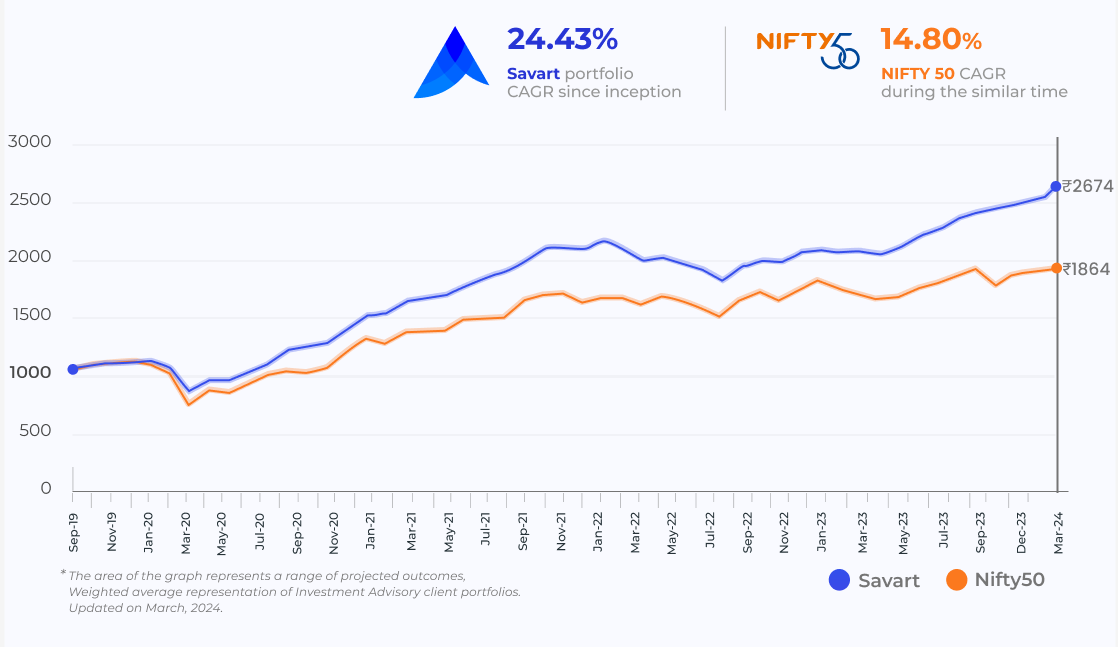

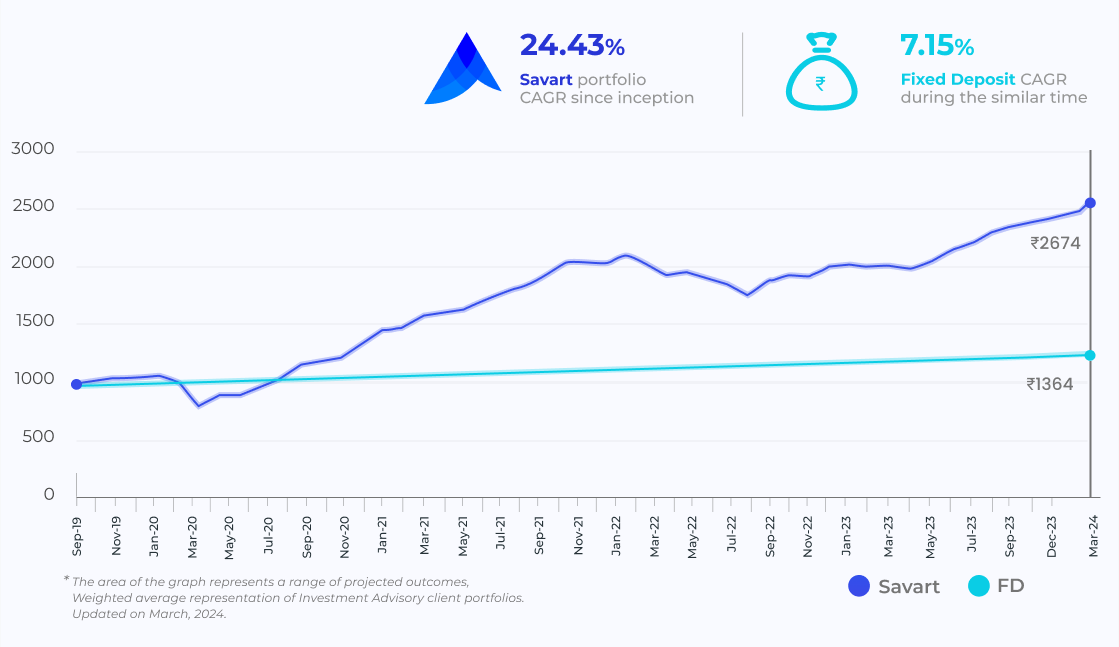

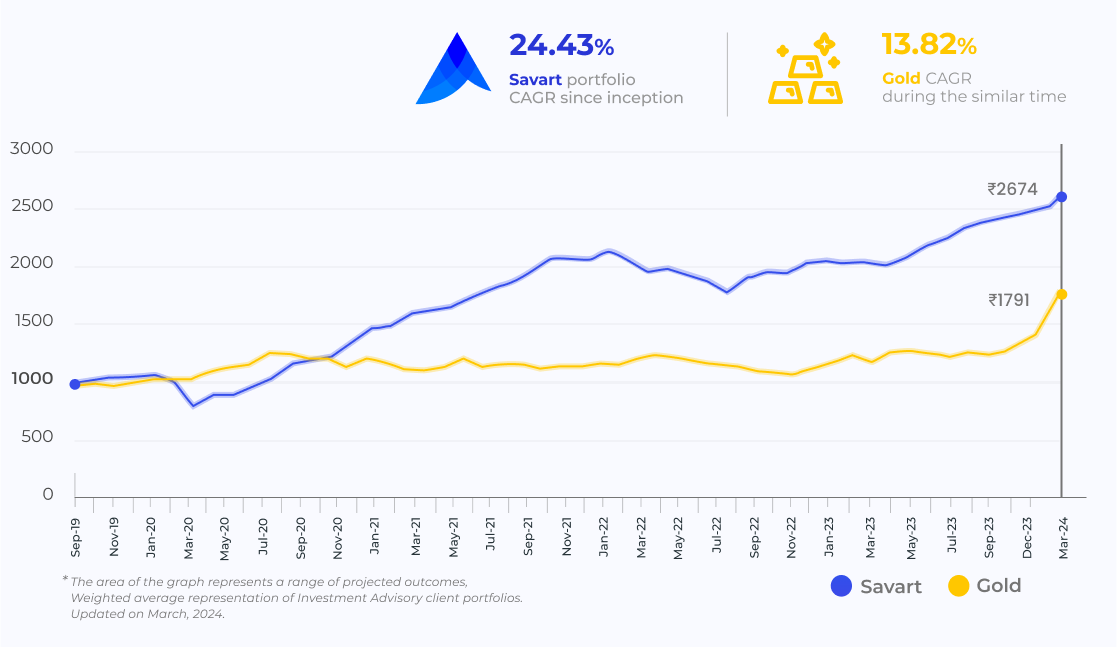

Experience Exceptional Long-term Performance With Our Acclaimed AI-powered Research

How Does Savart Work?

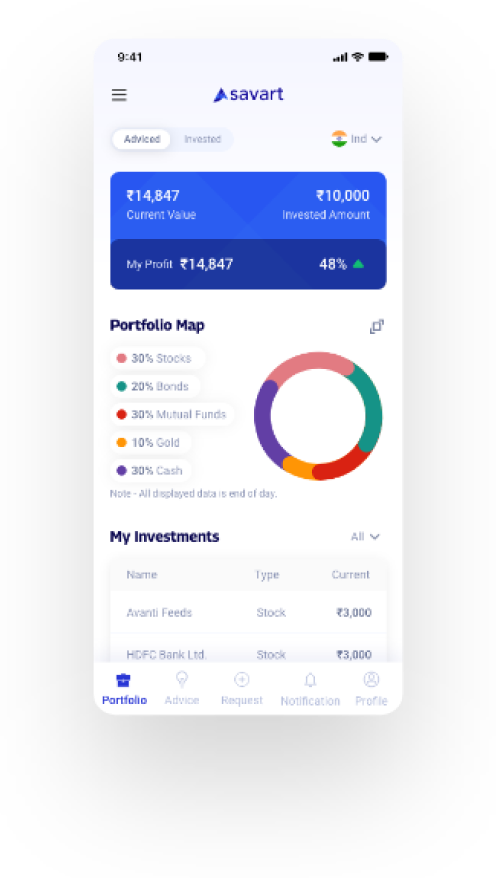

Investment Super App.

Savart is an end-to-end Investment solution. From goal-setting to investment advice, and from trade execution to portfolio tracking, we offer it all.

Global Opportunities

Whether it is a thriving pharma company in Toronto, an electric powerhouse in New York, or a tech startup in Bangalore–nothing misses our radar!

AI and Human Expertise

Experience the power of cutting-edge AI-technology, combined with patient, ethical and inclusive investing.

Savart in

Numbers

- Clients from Countries 33+

- Assets Under Advisory ₹ 2100+ Cr

- Users 165000+

Advanced Process

Automation & Research Technology

APART AI automates research to increase investment performance.

Savart’s recommendation and research activities are driven by its AI-based system called APART (Advanced Process Automation & Research Technology). APART automates not just advice but also the underlying research, making it unique among peers. A traditional Robo-advisor automates the ‘advisory process’ using a set of rules input directly or indirectly by a human analyst. On the contrary, APART controls the end-to-end process with its three sub-systems Know More .

Our Clients Speak

Thiyagarajan

IT Professional

Chandra Sekar

Businessman, Muscat

Rashika Reddy

Doctor

Ravi Kumar

Geologist

Rajendra Shandilya

Retired Businessman

Poorna Chandra

Software Professional

Prashanth Appala

Doctor

Kashish Suneja

Software Engineer

Need Help?

Chat with us now or call on +91 90520 12341

Request a Call

Enter mobile number

Savart in Media

Our Subscription plan will help you realize your financial dreams

- 24 investment advices per year from our AI system

- Goal-based wealth planning

- Customize your investments based on personal beliefs

- 4 security reviews from your personal (non-Savart) portfolio

- Advice on high-performance stocks, mutual funds and bonds

- Ability to invest in India, USA and Canadian markets

- Phone/Email/Chat support

x

Savart is India’s largest Investment Advisor based on number of unique portfolios under advisory.

4.7

4.7